MD&Partners is very happy to announce that it has been approved by Swiss Financial Market Regulator FINMA amongst the first 50 approved independent wealth managers.

FINMA regulatory barriers are among the highest to pass and we are proud that we can offer our certified expertise to our clients.

FINMA is tasked with protecting creditors, investors and policyholders and ensuring the financial markets function properly. We provide collective protection for clients; individual claims are a matter for the civil courts. FINMA's main task as a regulator is to make sure that all financial service providers comply with the rules and that the financial system is stable. We are responsible for authorising banks, insurance companies, stock exchanges and other market participants, including asset managers of collective investment schemes. We then monitor them and take action if they break the rules.

About finma (https://www.finma.ch/en/finma-public/)

You have unlimited access to your assets at all times. We foster and source an established, long standing collaboration with selected Swiss Banks. We can support and accompany you in choosing the bank that appropriate best for you.

FINMA regulatory barriers are among the highest to pass and we are proud that we can offer our certified expertise to our clients.

FINMA is tasked with protecting creditors, investors and policyholders and ensuring the financial markets function properly. We provide collective protection for clients; individual claims are a matter for the civil courts. FINMA's main task as a regulator is to make sure that all financial service providers comply with the rules and that the financial system is stable. We are responsible for authorising banks, insurance companies, stock exchanges and other market participants, including asset managers of collective investment schemes. We then monitor them and take action if they break the rules.

About finma (https://www.finma.ch/en/finma-public/)

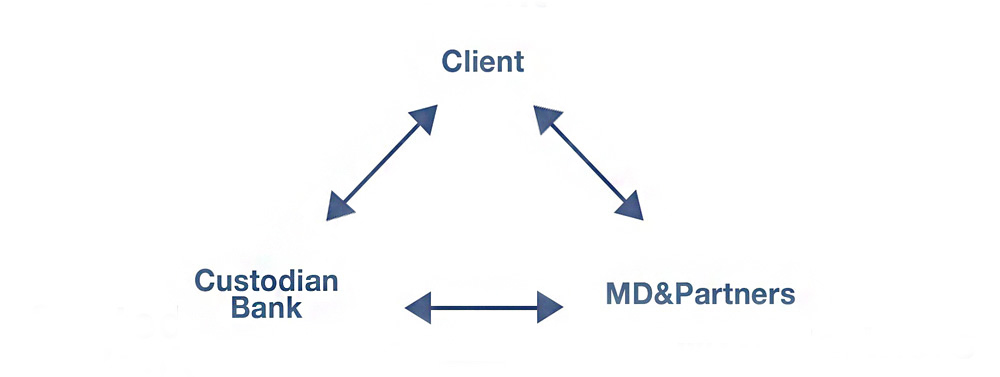

MD&Partners Discretionary Mandate Set-up

Your Assets, your Account, your BankYou have unlimited access to your assets at all times. We foster and source an established, long standing collaboration with selected Swiss Banks. We can support and accompany you in choosing the bank that appropriate best for you.

Opening of an account/custodian account with a bank which we carefully select based on your personal needs in Switzerland. Assign an order to the custodian bank to accept instructions from MD&Partners (these instructions are limited to the asset Management agreement between the client and MD&Partners)

MD&Partners gets a power of attorney from you to manage which means MD&Partners can not withdraw or transfer funds away from your account. You will regularly receive bank/account reports (e-banking).

The Bank administers the custody and current accounts in the name of the client or your company. In addition the bank handles duties such as the collection of interest and dividends, execution of transfers from you as well as the settlement of stock exchange orders, which they receive within the asset management (MD&Partners).

Market analysis like Geopolitics, Makro-Economics, Research of Stocks and decision of investment allocation. Conversion in Client Portfolio. Negotiates reduced trans-actions fees with the custodian bank in favour of you.

The license we have applied for will be finalized by Finma (Swiss supervisory authority), as follows the link:

https://www.finma.ch/en/documentation/legal-basis/laws-and-ordinances/finanzdienstleistungen/

MD&Partners as per December 14th 2021

OFS Ombud Finance Switzerland :

https://www.ombudfinance.ch/

Is directly supervised by AOOS:

https://www.aoos.ch/

Brunner Treuhand is our supervisory audit company::

https://www.brunner-treuhand.com

Legal & Compliance is placed externally with Cynos AG, Switzerland:

https://en.cynos.ch

Swiss Banking - Risks Involved in Trading Financial Instruments.

https://www.swissbanking.ch/en/downloads

Suisse des Gestionnaires de fortune | ASG.

https://www.vsv-asg.ch/fr

Risks Involved in Trading Financial Instruments

https://www.finma.ch/en/documentation/legal-basis/laws-and-ordinances/finanzdienstleistungen/

MD&Partners as per December 14th 2021

OFS Ombud Finance Switzerland :

https://www.ombudfinance.ch/

Is directly supervised by AOOS:

https://www.aoos.ch/

Brunner Treuhand is our supervisory audit company::

https://www.brunner-treuhand.com

Legal & Compliance is placed externally with Cynos AG, Switzerland:

https://en.cynos.ch

Swiss Banking - Risks Involved in Trading Financial Instruments.

https://www.swissbanking.ch/en/downloads

Suisse des Gestionnaires de fortune | ASG.

https://www.vsv-asg.ch/fr

Risks Involved in Trading Financial Instruments